Published on Zero Hedge (http://www.zerohedge.com)

Home > The Housing Bubble Explained in One Little Gem of an Excerpt...

By Tyler Durden

Created 12/19/2014 - 18:55

Submitted by Thad Beversdorf via First Rebuttal blog [9],

For some reason I feel like this is a good time to review what we can expect when our government and its agencies attempt to create wealth out of thin air. We can see the absurdity and hubris of our policymakers who believe they can circumvent economic laws in the following excerpt from the “The National Homeownership Strategy: Partners in the American Dream” [10]. This is a document that was put together by HUD and some other private and public stakeholders at the request of President Clinton way back in 1995. Isn’t it amazing how poor policies that seem so right at the time, to some, end up kicking us in the ass for decades. And as much as the government has gotten comfortable with the storyline suggesting banks are responsible for the entire mortgage bubble mess of the mid 2000′s, it was, in fact, all started by government agenda. Have a look at this little gem which I am suggesting is the document that led us to the economic devastation from which we are yet to crawl out.

For many potential homebuyers, the lack of cash available to accumulate the required downpayment and closing costs is the major impediment to purchasing a home. Other households do not have sufficient available income to to make the monthly payments on mortgages financed at market interest rates for standard loan terms. Financing strategies, fueled by the creativity and resources of the private and public sectors, should address both of these financial barriers to homeownership.

And while we all love a bit of creativity in life, maybe best to avoid creativity in an effort to ignore risk fundamentals. Yet our government was certain it could defy gravity. A child could tell you that if a person doesn’t have sufficient money to pay back a loan, well they shouldn’t have a loan in the firsplace. And so to force banks to lend depositors’ money to borrowers who have neither the required down payment nor the cash-flow to cover monthly payments is simply absolute unadulterated stupidity. Most of us, if we had been made aware of that thought process, would have put a stop to it straight away.

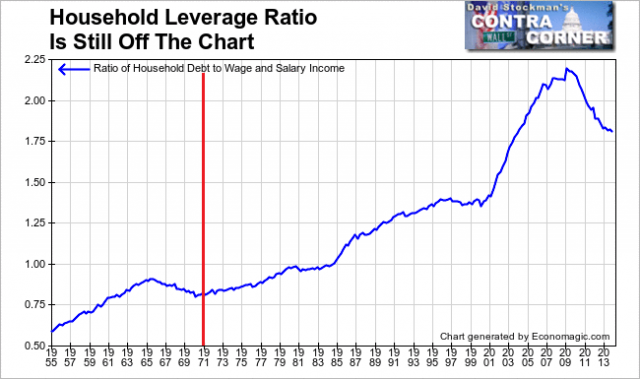

So what lesson did we learn the hard way? Looking around today, absolutely nothing. Our government officials and policymakers continue to operate under the presumption they are gods, not subject to the laws of this world. Despite creating such immense devastation last time around they have actually convinced themselves that they are not responsible (evidenced by the $350 billion they have pillaged from the banks in the name of justice for having created the housing bubble). And so by not acknowledging their mistake it allows them to still believe they can make pigs fly. Specifically, the central bank is printing incredible stocks of money and pushing it directly into the stock market in an effort to create economic growth from nothing. Their storyline is that such a strategy will create so much wealth at the top that it will spill over onto the rest of society. They also believe there will be no consequence to printing an unprecedented supply of dollars despite the laws of economics very clearly telling us there most certainly will be consequences.

Now while they have managed to delay the inevitable devastation, it is coming. You see everything is a trade off. You can create long drawn out overpriced markets but ultimately fundamentals will trump all and the subsequent recalibration will be that much more painful. The fundamentals always come back into the equation. Like anything, if you want to reduce the iterations you can but each iteration will then be larger. Let me show you what I mean by reviewing historical market trends.

The following charts depict monthly returns (green line) and S&P price level (blue line) with a 24 month moving average (black line). Note each chart depicts a different time period. The first chart is 1950 to 1981, the second is 1981 to 1993 and the last chart is 1993 to present. I’ve separated them in this way because there are 3 very distinct characteristics that are present between the three periods. Look closely at the 24 month moving average and compare them across the three periods.

What we discover from the first chart is that between 1950 and 1980 we see very even cyclicality in the 2 year moving average of quite moderate positive peaks and negative troughs repeating every 2 or 3 years. However, subsequent to 1981 we see something quite different. Our 2 year moving average no longer has negative troughs. In fact, the 2 year moving average stays positive and very calm from the end of ’81 through to mid ’93. The third chart takes us into the extreme bubbles phase. Here we see a strong positive trend with more variation than in the previous phase but with intermittent significant drawdowns. This is different from the first phase where drawdowns were very regular but minimal in size and not catastrophic. Whereas in this latest phase we have much longer periods in between drawdowns but each drawdown is many times more severe than in the first phase.

So this all begs the question why? What caused the normal market cyclical iterations to change so significantly seemingly out of nowhere? Well think about Fed policy between the three phases. In the early phase our monetary policy was constrained by Bretton/Woods. The second phase coincides with Volker taking over as Fed Chair and implementing very tight monetary policy with a focus shift to inflation control and so limiting money supply expansion. The final phase corresponds with a very sharp increase in M2 expansion that continues today.

And so these variations in market trends seem to correlate to the underlying monetary policies. Certainly there are significant changes within the sophistication of the market itself however, human behaviour is the same over time and markets react to market forces the same way over time. And so what is different then are the underlying market forces. And we see three very distinct market trends indicating there are three very different underlying market forces between the three periods. Understanding these differences should make it easy to identify and acknowledge how monetary policy is affecting markets.

There is perhaps no natural best trend but the people should decide which market behaviour suits what we want out of a market and then apply the appropriate policies accordingly. If large bubble build ups followed by infrequent but devastating crashes is the objective well then it appears our policymakers are right on point. But let’s try to understand exactly what is taking place.

You can see the acceleration of M2 expansion in the mid 1990′s that has yet to slow down. But money supply is not the only major underlying economic shift. Thing is if we are allocating that money supply efficiently then economic growth would be extraordinary and that would support the notion of all time high markets. So let’s see how efficiently we are deploying our money.

We can see back in the ’60′s and ’70′s efficiency of money allocation was fairly steady around 1.75. Then into the Volker years money velocity improved slightly in the first half of the decade and then really took off toward the end of the ’80′s and into the first half of the ’90′s. However, monetary efficiency seems to have peaked around the time M2 money stock started into it’s hyper-acceleration phase in the mid 1990′s. Since then monetary efficiency has been a falling knife, yet to hit the ground. And if we look at the next chart it really ties this altogether for us.

Right up until the early to mid 1990′s we were allocating money to economic boosting investments. Things like fixed capital reinvestment. However, toward the mid ’90′s we began to reallocate money toward financial markets and away from economic investments. This trend too continues today. The end result is that our economic policymakers and really the consciousness of society is so narrowly focused on “The Market” that we seem uninterested in all things not securitized. And what this suggests is that once again our policymakers believe they can ignore economic laws. That they can somehow create economic growth from nothing.

Last time it was handing out houses to folks who had not earned those assets in hopes that would somehow become real. This time its printing endless amounts of dollars, sticking them in the stock market money machine and expecting that to somehow create economic prosperity to all. It is mind boggling that men with so much power can be so incredibly thick. The hubris is par for the course with such power, but one would not expect such stupidity. The real ugliness of it all is that while those on top will ultimately create more wealth from the coming devastation, the vast majority of Americans have been forced to play along. Forced to put their savings in the money machine that is now the only game in town.

And so when it does inevitably all come tumbling down only 6 years after the last policies failure, it will mean the end for so many. And because those stories would reflect poorly on the prominent men whose stupidity led to such destruction those stories will not be told with truth. They will be told as though retirees were taking outrageous risks late in life when everybody knows you should not be in the market. Just as it was the banks, the borrowers and the brokers who were solely responsible for the housing bubble that devastated so many, including the folks you never hear about who lost 30% equity in their homes but continued to quietly and responsibly pay their mortgages. Yes once again those responsible will profit from their misguided policies and will bear no accountability for the horrible consequences of their decisions. Ah yes, America…. ain’t she wonderful!

The big question now confronts a newly-emergent Republican majority in the Senate and an overwhelming Republican majority in the House: what next? Some party leaders have called for working with the opposition; some have proposed comprehensive legislation. Others say it’s time to push forward with a hard-core conservative agenda, full speed ahead.

The big question now confronts a newly-emergent Republican majority in the Senate and an overwhelming Republican majority in the House: what next? Some party leaders have called for working with the opposition; some have proposed comprehensive legislation. Others say it’s time to push forward with a hard-core conservative agenda, full speed ahead.

.

.